MMN November 2024 – Milk Market Update

7 November 2024Dairy Commodity Markets

- Fonterra’s latest on-line GDT auction (5th November) resulted in a 4.8% increase in the weighted average price across all products, reaching US $3,997/t. This follows a 0.3% drop at the previous auction in mid-October. All products on offer sold at higher average prices than the previous auction, except for lactose, which was down 6.1% to $843/t. The biggest rises were seen in butter and anhydrous milk fat, up 8.3% (to $6,990/t) and 4.6% (to $7,558/t) respectively. Full results are available at https://www.globaldairytrade.info/en/product-results/

- The UK wholesale market for dairy commodities has eased from the all-time highs seen for butter and cream in September. Prices are now in decline due to higher milk volumes in September, along with higher levels of fat in the milk. Increased production has come on the back of good grass growth and higher production from Autumn block calving herds.

| Commodity | Oct 2024 £/t | Sept 2024 £/t | & Difference Monthly | Oct 2023 £/t | % Diff 2024-2023 |

| Bulk Cream | 3096 | 3,147 | -2 | 1,791 | +73 |

| Butter | 6500 | 6,730 | -3 | 4,070 | +60 |

| SMP | 2090 | 2,150 | -3 | 2,220 | -6 |

| Mild Cheddar | 4300 | 4,150 | +4 | 3,290 | +31 |

Source: AHDB Dairy - based on trade agreed from w/b 23rd Sep - 20th Oct 2024. Note prices for butter, SMP and mild cheddar are indicative of values achieved over the reporting period for spot trade (excludes contracted prices and forward sales). Bulk cream price is a weighted average price based on agreed spot trade and volumes traded.

- While supplies of butter and cream are still tight there is little product being traded forward given market uncertainty and buyers hope that prices will fall further. Butter stocks are tighter than cream, given that it is more cost-effective to sell cream than process it into butter. Tight butterfat supplies have also been seen in the EU and this has greatly impacted the global markets. While the EU milk supply usually increases seasonably in November and December, it is likely that butter availability will remain tight, partly driven by continuing demand for cheese. In addition, bluetongue infections continue to affect milk output in northwest Europe, although the duration and extent of its impact on milk supplies is difficult to predict, with several control measures in place and use of vaccines.

- The UK SMP price was also down for October, following the trend seen in global markets and expectations of higher milk volumes going forward, both domestically and abroad.

- Mild cheddar bucks the trend with a 4% increase in the average price for the month, and while cheese markets are usually slower to respond to market forces compared to butter or cream, futures cheese prices into next year for both Q1 and Q2 are down.

- With falling prices for butter and cream, it was no surprise that AMPE fell by 1.66ppl for October but MCVE continued to rise by 1.69ppl on the back of the positive movement in mild cheddar price. While the Milk Market Value indicator went up from 45.36ppl in September to 46.38ppl in October, the rise was less than it has been over the last five months. The average Defra farm-gate milk price for September was 43.06ppl, up 1.5ppl from August.

| Oct 2024 ppl | Sep 2024 ppl | Oct 223 ppl | Net amount less 2.4ppl average haulage - Oct 2024 ppl | |

|---|---|---|---|---|

| AMPE | 45.49 | 47.51 | 34.53 | 43.09 |

| MCVE | 46.60 | 44.91 | 34.59 | 44.20 |

Source: AHDB Dairy

GB Milk Deliveries and Global Production

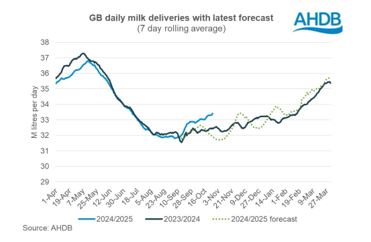

- Since mid-September, milk production has jumped on the back of more favourable grass growth and grazing conditions, and volumes are now well above this time last year. Daily deliveries for the w/e 26th October were 33.41 million litres, which is 0.4% more than the previous week and 2.9% higher than the same week last year (equating to an extra 950,000 litres/day). The recent AHDB milk forecasting forum estimates that GB production for the 2024/25 milk year will be 12.28blitres, just 0.3% less than the previous year.

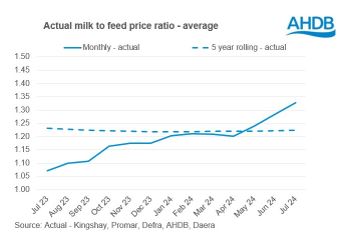

- Given that milk prices are still rising, the milk price to feed price ratio is favourable, meaning there is more incentive to feed more concentrates to cows to stimulate milk production, which should return a financial benefit. The latest data from AHDB put the ratio for July at 1.33, with above 1.25 being classed as the expansion zone for milk volumes and when the ratio is between 1.15 and 1.25, milk production is predicted to be stable. Below 1.15 production is expected to contract as either low milk prices and/or high feed costs do not encourage higher feeding rates.

- Global milk deliveries for the six key exporting regions totalled 782mlitres/day for August which is just 0.1% down on the same month last year. Production in August was up in Australia (+2.9%), New Zealand (+9.0%) and the US (+0.4%), with declines seen in Argentina (-6.2%) the EU (-1.0%) and the UK (-0.1%). Argentina has been suffering with prolonged drought and this has greatly impacted forage supplies, hence the significantly lower output.

- At the end of August, Rabobank were predicting that milk production from the seven key regions (US, New Zealand, EU, Australia, Argentina, Uruguay and Brazil) would increase in the 2nd half of 2024, resulting in a 0.14% growth in milk for the whole of 2024, and a 0.65% increase in supply in 2025 over 2024 production. So far New Zealand have had a good start to their milk production year on the back of favourable conditions for grass growth. Small changes in supply can greatly impact market prices and if global commodities fall on the back of increasing supply, EU markets will also be affected, impacting our domestic market and farm-gate milk price.

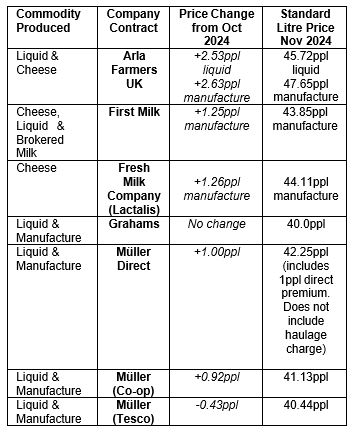

Monthly Price Movements for November 2024

Other News

- A study by the University of East Anglia has revealed that methane emissions from slurry stores may be as much as five times higher than previously thought. Measurements came from slurry lagoons on two Cornish dairy farms during 2022/23, where the lagoons were sealed with airtight covers and the methane captured. The actual emissions from the two farms were 145kg/cow/year and 198kg/cow/year respectively, but the current official figure from the UK’s National Inventory is just 38kg/cow/year. If that methane can be captured and converted into biogas (with the technology already existing), it could be worth £52,500 to the average-sized dairy farm.

- Dental health in cattle is perhaps a topic that doesn’t cross many farmers minds. However, dental health has been brought to the forefront by Jillian Gordon, founder of Ovation Agriculture. This Edinburgh-based company is planning to manufacture a dental gag for cattle to aid treatment and prevent dental conditions that can significantly impact welfare and therefore productivity. In addition to manufacturing tools to carry out dental checks, the company will also deliver courses in dental knowledge and treatment management skills.

- Arla’s recent survey of 472 members revealed worrying statistics on labour and recruitment. Over half of those surveyed said it was increasingly hard to recruit staff, with 86% of those with vacancies saying they had received very few or no candidates with the required skills. Wages are now 27% higher than pre-Covid levels and as a result, 8.5% have reduced milk output, 10.6% have cut cow numbers and almost 16% said they are thinking about quitting milk production (up from 12% last year).

- Recent cost of production data from The Dairy Group highlighted an 8.9ppl difference between the top 25% compared to the average dairy farm. For 2023/24 the cost of production was 45ppl with a loss of 0.6ppl, largely attributed to a drop in milk price of 5.3ppl. For the 2024/25 year, the cost of production is estimated at 44.2ppl, back 0.8ppl mainly due to lower feed costs. The forecast is for a small profit of 0.5ppl after family labour is accounted for.

lorna.macpherson@sac.co.uk; 07760 990901

Sign up to the FAS newsletter

Receive updates on news, events and publications from Scotland’s Farm Advisory Service