MMN March 2025 – Milk Market Update

11 March 2025Dairy Commodity Markets

- Fonterra’s latest on-line GDT auction (4th March) resulted in a 0.5% decrease in the weighted average price across all products, reaching US $4,209/t. This follows a 0.6% drop at the previous auction on 18th The biggest decline was seen in whole milk powder, down 2.2% to $4,061/t. The biggest increases at the most recent auction were see in lactose (+14%), mozzarella (+7.9%) and butter (+2.2%). Full results are available at https://www.globaldairytrade.info/en/product-results/

- UK wholesale prices of dairy commodities continue to decline, with the exception of bulk cream, which showed virtually no change in the average monthly price from January into February. Butter showed the biggest drop, down 4%. While milk volumes are slowly increasing, stocks of butter are still reported to be low. While mild cheddar fell by just £30/t in February, demand for cheese is thought to continue to rise. Markets were fairly quiet over the reporting period, with buyers anticipating lower prices with the impending spring flush.

| Commodity | Feb 2025 £/t | Jan 2025 £/t | % Difference Monthly | Feb 2024 £/t | % Diff 2025-2024 |

|---|---|---|---|---|---|

| Bulk Cream | 2626 | 2630 | 0 | 1996 | +32 |

| Butter | 5920 | 6180 | -4 | 4850 | +22 |

| SMP | 2020 | 2090 | -3 | 2140 | -6 |

| Mild Cheddar | 3960 | 3990 | -1 | 3530 | +12 |

Source: AHDB Dairy - based on trade agreed from w/b 27th Jan – 23rd Feb 2025. Note prices for butter, SMP and mild cheddar are indicative of values achieved over the reporting period for spot trade (excludes contracted prices and forward sales). Bulk cream price is a weighted average price based on agreed spot trade and volumes traded.

- It is a similar trend in the EU with butter down around 2% in January (and back 6% from its December peak) and milk volumes up between 1-2%. UK milk volume was up 3.6% for January. The EU SMP price has been stable over the last six months, and cheddar has been rising, up 3.9% in January. Even though EU milk supplies are up, demand has also been improving after the usual post-New Year drop.

- Given the declining butter price, the market indicator AMPE fell just over 2ppl for February and MCVE fell just 0.29ppl on the back of the more stable cheddar price. The Milk Market Value has dropped for the fourth month in a row, back 0.64ppl for February to 43.0ppl from a high of 46.37ppl in October.

| Feb 2025 ppl | Jan 2025 ppl | Feb 2024 ppl | Net amount less 2.4ppl average haulage - Feb 2025 ppl | |

|---|---|---|---|---|

| AMPE | 42.00 | 44.01 | 37.65 | 39.60 |

| MCVE | 43.25 | 43.50 | 36.77 | 40.85 |

Source: AHDB Dairy

- The Defra farm-gate milk price for January was 46.01ppl, which was 0.57ppl down from December’s price. Estimates from the Dairy Group are for the Defra milk price to drop to around 45ppl for February and 44ppl for March.

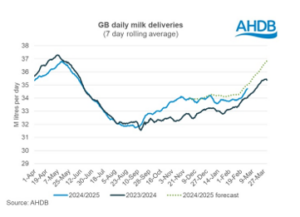

GB Milk Deliveries and Global Production

- Daily deliveries for the w/e 1st March were 34.71 million litres, which is 1.6% more than the previous week and 2.0% higher than the same week last year (an extra 680,000 litres/day). Milk production is heading northwards and AHDB predict that GB production will be up 1.1% in 2025. The milk price to feed price ratio continues to be favourable for continued growth in production and so far, it has not been as wet a spring as last year, which hopefully means better grazing conditions for those with an early turnout to grass.

- UK milk production figures from Defra were at 1,295 million litres for January, 1.1% higher than December production.

- Global production in the six key exporting regions reported on by AHDB show growth for November 2024, with daily deliveries at 817.6 million litres, an extra 7.3 million litres/day compared to November 2023. The EU, UK, Argentina and New Zealand all showed growth in volume, with Australia and the US slightly down (0.2% and 1% respectively). The drop in US production is mainly attributed to the significant avian flu outbreak in Californian dairy herds. Looking ahead, it is forecasted that globally milk prices will fall in the second half of 2025 and this will be strongly influenced by spring weather and the extent of the spring flush in both the EU and the US. Global markets tend to soften when production growth is up around 1%, with many of the key milk producing areas already up more than 1% in volume compared to the same time last year.

Monthly Price Movements for March 2025

| Commodity Produced | Company Contract | Price Change from Feb 2025 | Standard Litre Price Mar 2025 |

|---|---|---|---|

| Liquid & Cheese | Arla Farmers UK | No change | 46.58ppl liquid 48.27ppl manufacture |

| Cheese, Liquid & Brokered Milk | First Milk | No change | 45.35ppl manufacture |

| Cheese | Fresh Milk Company (Lactalis) | No change | 44.72ppl manufacture |

| Liquid & Manufacture | Grahams | No change | 40.0ppl |

| Liquid & Manufacture | Müller Direct | No change | 42.25ppl (includes 1ppl direct premium. Does not include haulage charge) |

| Liquid & Manufacture | Müller (Co-op) | No change | 40.95ppl |

| Liquid & Manufacture | Müller (Tesco) | No change | 40.02ppl |

Other News

- Organic milk prices are on the rise, with Organic Herd increasing their milk price by 1.68ppl for April. This brings their farm-gate price to 57.68ppl. While organic dairy product demand is increasing, Organic Herd were also keen to ensure that the inflationary costs farmers are dealing with are accounted for to help ensure long-term security of milk supply. The Arla Farmers organic milk price (manufacturing) for March is 58.26ppl.

- A new handling system to help manage “downer cows” was launched at Dairy Tech last month and is now available for purchase. The CowRecovery system was developed by Dorset dairy farmer James Yeatman and has been trialled on a number of dairy farms across the UK. It uses a specially modified telehandler bucket and moving technique to minimise risk of injury to both the cow and personnel when dealing with downer cows, helping improve their overall welfare. The equipment also comes with a full training programme developed by Synergy farm vets. For more information see: cowrecovery.com.

- Farmers with a Co-op milk contract are set to benefit from a change in the pricing mechanism used to set their milk price. Farmers will get paid more for milk, with the Co-op looking to invest nearly £1million in dairy farming. As of 1st April, their milk price will move to the Müller direct price of 42.25ppl, an increase of 1.3ppl. Co-op have also agreed a long-term supply contract with Müller.

- A Defra funded project led by AFBI (Agri-Food and Biosciences Institute) is looking to establish a network of 56 dairy farms across the four key dairying regions in the UK, including south-west Scotland. Called the UK Dairy Carbon Network, the project aims to significantly reduce carbon emissions through a number of innovative mitigation measures including dairy herd management, land use, nutrient management, with more efficient use of nitrogen and phosphorus, and technology. More information about how this farming network will work will be provided by AHDB and Agrisearch shortly, allowing interested farmers to volunteer for the project. For more information, visit the following link: AFBI led Project Launched to Promote Sustainable Dairy Farming across the UK | Agri-Food and Biosciences Institute

lorna.macpherson@sac.co.uk; 07760 990901

Sign up to the FAS newsletter

Receive updates on news, events and publications from Scotland’s Farm Advisory Service