MMN July 2024 – Milk Market Update

15 July 2024UK Wholesale Dairy Commodity Market

- Fonterra’s latest on-line GDT auction (2nd July) resulted in a massive 6.9% drop in the weighted average price across all products, reaching US $3,782/t. This follows a 0.5% decrease at the previous auction, the first negative result since mid-March. Only lactose increased in price from the previous auction (+0.5%). The biggest drops were seen in anhydrous milk fat, butter and cheddar, down 10.9%, 10.2% and 6.9% respectively. Full results are available at https://www.globaldairytrade.info/en/product-results/

- All UK wholesale price of dairy commodities showed a positive increase from the May reporting period. In particular, big rises were seen for butter and cream, up 11% and 9% respectively. Given the lower peak in spring milk production and the seasonal drop in butterfat at this time of year, butter stocks are now very low. Concerns around lower milk volumes sparked more buying activity, and with retail demand increasing, the markets responded accordingly. The significant drop in milk production in Ireland is also contributing to the high fat prices and butter production is now down 4.6% year-on-year in Europe.

| Commodity | Jun 2024 £/t | May 2024 £/t | % Difference Monthly | Jun 2023 £/t | % Diff 2024-2023 |

|---|---|---|---|---|---|

| Bulk Cream | 2,292 | 2,104 | +9 | 1,622 | +41 |

| Butter | 5,660 | 5,080 | +11 | 3,990 | +42 |

| SMP | 2,060 | 2,010 | +2 | 2,060 | 0 |

| Mild Cheddar | 3,670 | 3,540 | +4 | 3,560 | +3 |

Source: AHDB Dairy – based on trade agreed from w/b 20th May – 10th Jun 2024. Note prices for butter, SMP and mild cheddar are indicative of values achieved over the reporting period for spot trade (excludes contracted prices and forward sales). Bulk cream price is a weighted average price based on agreed spot trade and volumes traded.

- The market for SMP showed little movement, although positive, with the price up £50/t on average for the month. EU manufacturers appear to have little stock, helping keep prices firm. In addition, global buying activity picked up around the time of the EU/USA milk flush, increasing demand during peak supply season.

- Mild cheddar also rose on the back of sellers reluctant to unload product too cheaply and would prefer to hang onto stocks to make mature cheddar, rather than undersell.

- There was a significant rise in AMPE this month, up 3.42ppl from May and 7.84ppl more than June last year, mainly due to the rise in the butter component. MCVE also rose but only by 1.79ppl, on the back of increases in mild cheddar and the whey powder and whey butter components. These rises were reflected in the Milk Market Value which was up 2.11ppl to 38.65ppl for June, the biggest monthly rise seen so far this year. As changes in MMV are often reflected in movements in farm-gate prices in three months’ time, this is looking positive for further milk price increases later this summer.

| Jun 2024 ppl | May 2024 ppl | Jun 2023 ppl | Net amount less 2.4ppl average haulage - Jun 2024 ppl | |

|---|---|---|---|---|

| AMPE | 40.50 | 37.08 | 32.66 | 38.10 |

| MCVE | 38.19 | 36.40 | 37.59 | 35.79 |

Source: AHDB Dairy

- Defra put the UK average farm-gate milk price at 37.92ppl for May, 0.49ppl less than the April price. The UK volume for May was 1,377 million litres, which was 5% more than the previous month but 0.9% back on May 2023 volume.

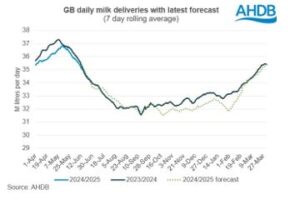

GB Milk Deliveries and Global Production

- Milk production is now on a par with last year, with daily deliveries for the w/e 29th June at 34.05 mlitres,1.1% less than the previous week and 0.1% above the same week last year (+20,000 litres/day).

- Global production is still slightly behind 2023 volumes. Daily deliveries in April from the six main exporting regions averaged 832.5 litres, 3.8 mlitres less/day compared to April 2023. While EU volumes were higher than last year, Irish production continued to decline, down 81 mlitres (7.9%) in April. The biggest percentage decline was seen in Argentina, back 16.2% compared to April last year. This equates to 4.6 mlitres less per day, as a result of prolonged heavy rainfall and economic challenges, with triple digit inflation, recession and rising unemployment. Declines were also seen in the US and New Zealand, back 0.6% and 4.1% respectively.

Monthly Price Movements for July 2024

| Commodity Produced | Company Contract | Price Change from Jun 2024 | Standard Litre Price Jul 2024 |

|---|---|---|---|

| Liquid & Cheese | Arla Farmers UK | +0.81ppl | 41.7ppl manufacture |

| Cheese, Liquid & BrokeredMilk | First Milk | +0.8ppl | 40.3 ppl manufacture |

| Cheese | Fresh Milk Company (Lactalis) | +0.79ppl | 40.32ppl manufacture |

| Liquid & Manufacture | Grahams | +1.0ppl | 37.0ppl |

| Liquid & Manufacture | Müller Direct | +1.0ppl | 39.0ppl (includes 1ppl premium. Does not include haulage charge) |

| Liquid & Manufacture | Müller (Co-op) | No change | 39.96ppl |

| Liquid & Manufacture | Müller (Tesco) | No change | 41.82ppl |

Other News

- According to Nick Holt-Martyn of The Dairy Group, the estimated cost of production for the 2023/24 milk year was 43.4ppl. Variable costs and fixed costs were 12.2% and 21.2% respectively above the 2021/22 milk year. His prediction is that the cost of production will increase towards 45ppl and it is extremely unlikely that it will ever fall back below 40ppl.

- First Milk will increase its milk price by 0.7ppl from 1st August, bringing it up to 41ppl for a standard manufacturing litre.

- Organic Herd (formerly OMSCO) have increased their member milk price by 1ppl from 1st July bringing their standard litre up to 51ppl. There is also a further 3ppl rise for August. This comes in response to an increase in demand for organic milk and the co-op is also recruiting more farmers to help meet both the domestic and export demand. The production of organic milk has dropped significantly over the last few years, but as food inflation falls the prospects for organic milk and dairy products is on the up. Organic milk production in May was back 9.7% on the same month last year and for the 2023/24 milk year, milk volumes were down 14% on the previous year.

- Data from AHDB from the 12-month period up to April 2024 shows that the use of sexed semen has continued to increase and now represents 84% of all dairy semen sales, up from 76% last year. Sales of beef semen are now above that of dairy semen sales, representing 52% of all semen sold to dairy farmers. The Holstein breed remains the most popular, accounting for 88% of dairy sexed semen sales, up from 84% in the previous year.

- Denmark is looking to introduce the world’s first carbon tax for agriculture, with their government looking to approve the tax through parliament later this year. As of 2030, farmers will have to pay 300 krone (around £35) per tonne of CO2 equivalent emissions from livestock, increasing to 750 krone (around £85) from 2035 onwards. However, a 60% tax break will be applied, so farmers will in effect have to pay 120 krone (around £15) per tonne of CO2e each year from 2030 and 300 krone (around £35) in 2035. For dairy farmers on the lower tax rate, the charge will be around £75/cow initially, increasing to £190/cow in 2035.

Sign up to the FAS newsletter

Receive updates on news, events and publications from Scotland’s Farm Advisory Service