Milk Manager News March 2023 – Market Update

10 March 2023UK Wholesale Dairy Commodity Market

- Fonterra’s latest on-line GDT auction (7th March) resulted in a 0.7% fall in the weighted average price across all products, reaching US $3,403/t. The previous auction on the 21st of February also returned a drop in the price index of 1.5% and four out of the five auctions held so far this year have showed a negative trend. Cheddar was the biggest mover in price, dropping 10.2% to $4,509/t. Butter milk powder and skim milk powder also fell 4.5% (to $2,521/t) and 1.1% (to $2,739/t) respectively. Full results are available at https://www.globaldairytrade.info/en/product-results/

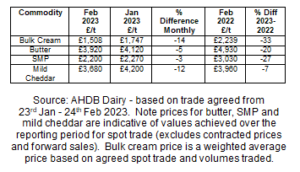

- Prices of domestic dairy products continue their downward trend, with cream showing the biggest drop in average price from January into February. Despite a jump in the butter price and increased demand in the EU, ample supplies of cream kept pressure on the market and prices ranged throughout the trading period from £1,400/t to £1,600/t.

- There was significant volatility in the butter market, with prices rising on the back of increased buying from the falling price earlier in the trading period and the unexpected 3.2% rise in the average price of products sold in the GDT auction on the 21st of February. There are signs that domestic commodity prices are starting to stabilise, with smaller price drops seen in February. Prices for butter, SMP and whey milk powder are down between 31-39% from their peak in October, with cream and mild cheddar back 50% and 26% respectively.

- Demand for mild cheddar has been subdued and rising stocks on the back of product made when milk supply increased last Autumn has contributed to the average price falling by 12% in February. The price has also been affected by lower prices of fresh cheeses in the EU.

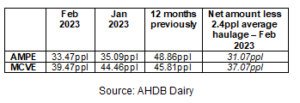

- The market indicators AMPE and MCVE continue to fall for February, with AMPE dropping 1.69ppl and MCVE by 4.99ppl since last month. The drop in MCVE is mainly attributed to the mild cheddar component falling 5.71ppl, while the whey powder component increased marginally by 0.83ppl. The drop in AMPE was significantly less, with the butter component 1.01ppl less and the SMP component back 0.58ppl from January. The Milk Market Value (MMV) of milk also plunged from its January price of 42.58ppl to 38.27ppl for February. MMV prices tend to closely compare with changes to the farm-gate milk price in three months’ time.

- Defra put the UK average farm-gate milk price at 51.51ppl for December, up 0.45ppl from November and 49% higher than December 2021. The UK volume for December was 1,238 million litres, which was 3.2% more than the previous month and 1.7% higher than December 2021. The Dairy Group’s milk price forecast puts the February price at 47ppl, 43.5ppl for March and 41ppl for April. From April onwards, milk price will be dictated by milk volumes and any changes in liquid and cheese prices, but it is expected that marginal litres could be in the region of 30ppl.

- For the week ending 3rd of March, cream was trading around £1.60-£1.65/kg ex works (the previous week it ranged from £1.62 up to the low £1.70’s/kg). The price for spot milk has been weakening and has now fallen below the 40ppl mark, ranging from 31 to 38ppl delivered. For the previous week, it was in the region of 32-40ppl.

GB Milk Deliveries and Global Production

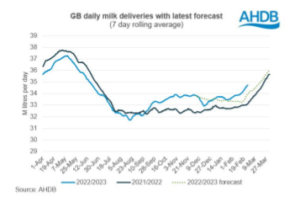

- For the week ending 25th of February, deliveries were up 1.5% on the previous week, with a daily average of 34.74 million litres/day. Deliveries are now 4.9% above the same week in 2022, equating to an additional 1.64 million litres/week.

- Looking ahead, the cold weather is forecasted to continue well into March, and with snow currently in much of the country, grass growth will be limited. For those in areas of low forage stocks, the relatively dry spring will be favourable to turning out cows, but milk production may be limited by slow spring grass growth.

- Global milk deliveries from the six key exporting regions for December were slightly above last year’s production, with a daily average of 808 million litres/day, 0.4% higher than December 2021 (an extra 3.1 million litres/day). This increase mainly came from the UK, EU-27 and US, with production up 1.5%, 0.9% and 0.8% respectively compared to December 2021. In the EU, increased production was mainly driven by growth in Germany (+3.1%), Netherlands (+4.1%) and Ireland (+7.4%). Production in the southern hemisphere has been impacted by poor weather conditions, especially in Australia where production was back 6.5%.

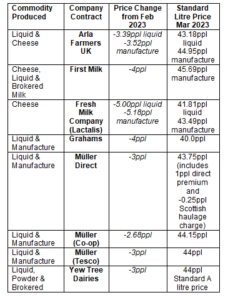

Monthly Price Movements for March 2023

- All major milk buyers in Scotland have significantly reduced their milk price for March, ranging from 2.68 to 5ppl. However, price movements will depend on the type of contract, with those dairy farmers on a Müller M&S contract having seen their March milk price maintained at 52.66ppl.

Other News

- Substantial milk price cuts have already been announced for April by two of the UK’s biggest processors (amongst others). First Milk is set to drop its price by 3ppl to 42.69ppl (for manufacturing) and Müller by 1.5ppl to 42.5ppl on the back of continued market pressures, with a reduction in consumer demand and milk supply above forecasted levels. So far, current announcements for April put Glanbia Cheese at the bottom of the table with their manufacturing standard litre down 4.5ppl to 38.75ppl and their liquid standard litre down 4.31ppl to 37.44ppl.

- Arla has reinforced its commitment to reducing emissions across its value chain by 30% no later than 2030, by stating its farmers will receive a higher milk price based on actions taken to reduce environmental impact. Farming accounts for over 80% of the Co-op’s carbon footprint. The first incentive payments, based on a points system, will be made in August this year and farmers can earn up to three eurocents per kg of milk. Points will be awarded based on actions taken in the following areas:

- Investing in renewable energy

- Efficiency in manure management and fertiliser use

- Production of biogas

- Impact on nature

- Demonstrate sustainable feed supply chains

- Efficient feeding management

- There is a wealth of information available on the findings of the Dairy-4-Future project on the CAFRE website. This was an EU Interreg funded project involving 100 dairy farms across eight countries in western Europe in the Atlantic Area. The project aimed to improve the competitiveness, resilience and sustainability of dairy farms in the area by developing innovative and efficient farming systems, as well as strengthening collaboration between the farms and various research and industry partners. More information on this three-year project and findings can be found here: https://www.cafre.ac.uk/business-support/agriculture/dairy/dairy-4-future/

lorna.macpherson@sac.co.uk; 07760 990901

Sign up to the FAS newsletter

Receive updates on news, events and publications from Scotland’s Farm Advisory Service