Agribusiness News September 2022 Sector Focus – Dairy

1 September 2022Managing costs in the dairy herd this winter

Despite record milk prices, with increasing energy costs and feed prices likely to remain high again this coming winter, maximising technical performance and business efficiency in the dairy herd is more important than ever.

Forage and feed planning

With reports of wet 1st cut silages in the west of the country, and many light 2nd cuts on the back of very dry weather, now is the time to assess forage stocks for the winter and address any potential shortfall. All forages on the farm should be analysed to enable a feed budget to be carried out.

Nutritionists can help work out forage requirements for each class of stock on the farm to calculated total requirements for the winter housing period. Knowing the quality of all forages also allows decisions to be made on what to feed to what stock. If extra forage or forage replacers need to be purchased, it is worth booking ahead to guarantee supplies.

While cereal prices have greatly eased off the highs seen back in July; proteins and fibre sources such as sugar beet pulp or soya hulls are not likely to be much cheaper for the winter period and it may be worth looking to fix a proportion of your winter feed requirements now.

Key performance indicators (KPI’s)

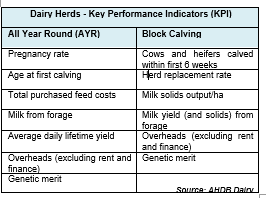

Dairy businesses should benchmark their herd’s technical performance and compare their figures to previous years and to other herds of comparable size/management system to gauge how well they are performing. Although there are many KPI’s, the following are critical for good performance:

For more detail on KPI targets see: https://ahdb.org.uk/dairy-kpis

Focus on fertility

Fertility is the key driver of profit in the dairy herd, with good fertility and hitting the 100-day in-calf rate target of > 65% helps keep days in milk down and average daily milk yield up. Getting cows in calf at the right time also helps reduce the risk of over-conditioned cows at calving, which can increase the likelihood of transition diseases and poorer performance in the next lactation.

Over the longer-term, think about replacement heifer requirements, particularly if forage stocks are going to be tight. Is all the youngstock on the farm needed or can surplus heifers be sold? While it could be tempting to serve more animals to beef, given the income value from beef calves, this can be false economy in the longer term if there are insufficient heifers available to replace poorer performing cows.

Maximising Margins

From a financial point of view, the crucial financial indicator is cost of production, both the cash cost and full economic cost. As feed accounts for around 70% of variable costs, improvements in milk from forage, margin over concentrates/purchased feed and reducing concentrate use per litre (feeding over 0.4kg/litre is seen to be inefficient) will all help to reduce the cost of production if milk output is not significantly compromised.

With energy prices set to rise even further in October, businesses should conduct an energy audit to identify where savings can be made. Cooling milk, heating water and the vacuum pump account for the majority of energy use, with each of these accounting for between 20-30% of total energy usage.

The cost of production for August was calculated at around 42.5ppl by some of the supermarket aligned producer groups, which suggests that for good performing herds, there is margin to be made. Nevertheless, farmers must continue to focus on controlling costs while maximising output, herd health and fertility in the face of challenging times ahead.

Given the continuing decline in the GDT auction prices of dairy commodities and domestic wholesale prices of butter, cream, SMP and cheese starting to fall, the question concerning everyone now is how long will milk prices continue to hold at the current level?

lorna.macpherson@sac.co.uk, 07760 990 901

Sign up to the FAS newsletter

Receive updates on news, events and publications from Scotland’s Farm Advisory Service