Agribusiness News October 2023 – Inputs: Feed

29 September 2023Feed Market Update

Monitoring the feed market and buying at the optimum time is vital to managing variable costs in any successful livestock production system. The feed market has been volatile for the last couple of years with prices consistently fluctuating towards record highs. However, this summer we have witnessed a downward trend as the markets begin recovering from earlier turbulence.

Cereals

After a challenging harvest due to changeable weather, the cereal harvest is nearing completion with predominantly spring barley remaining in Scotland at the time of writing (late September).

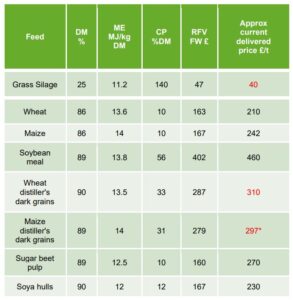

Table 1: Nutritional Value, relative and approx. costs of common feed ingredients (cost accurate at the time of writing – subject to change).

Note: relative feed value calculated using barley as an energy source at £170/t and rapeseed meal for protein at £310/t.

Malting quality has reportedly been variable with many Scottish maltsters having to raise rejection cut-offs to fulfil contracts. The main reason for this has been due to high levels of skinning and small grains from secondary growth. This has increased the availability of feed barley for livestock. However, the quality of the feed barley must be considered particularly if it has been retained from malting stock due to lower protein requirements for malting.

With the availability of both wheat and barley plentiful, worldwide prices are significantly back from this time last year with wheat currently sitting around £210/t from £260/t and barley around £170/t from £262/t delivered. At the time of writing, the market remains bearish, but prices are starting to see a slight rise as feed demand increases as we approach housing. Worldwide availability has also increased as the first boats have been loaded from Ukraine following the opening of the Black Sea corridor.

Proteins

The protein market is currently also back from this time last year, with soya bean meal currently around £440/t ex store. This is largely due to the US crop of soybeans being better than initially anticipated. However, there is some uncertainty due to a spell of high heat in the US that may affect the projected supply, turning the focus onto the Brazilian crop. Brazil’s exports have increased over the year following a record crop last harvest and has also been helped by a strong demand from China for Brazilian soybean meal. Rapeseed is very likely to follow the soybean market in the short term and is currently sitting at around £310/t delivered. Long-term supplies look to be healthy despite a reduction in yield from both the EU and Canada leaving the market bearish for now.

Other protein sources such as distiller’s grains have also followed a similar trend and are back on this time last year, currently sitting at around £297/t for maize distillers and £310/t for wheat distillers (delivered). Although it is worth speaking to suppliers as some good deals are too be had when supply is plentiful. The relative feed values (Table 1) of distillers are currently sitting close to cost, making them a good buy currently.

Silage

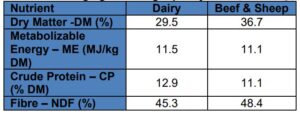

Initial samples going through the lab are showing on average that silage quality is good. However, we are early in the season for analysis and averages are likely to change as more samples come through the lab. Dry matter, energy and protein continue to be variable with a wide range and this should be considered when making decisions on winter ration depending on the class of stock and on-farm performance goals.

Table 2: Average grass silage quality 2023 (to end Aug.)

Lorna Shaw, lorna.shaw@sac.co.uk

Sign up to the FAS newsletter

Receive updates on news, events and publications from Scotland’s Farm Advisory Service