Agribusiness News June 2024 – Sheep

31 May 2024Lamb Marketing Roller Coaster continues to gain strength as we transition onto new season lambs. The week ending 18th May had an SQQ of £9.27/kg…

- 4p/kg rise on the week

- 184p/kg rise on the year!

With global supplies tightening, and the Muslim festival of sacrifice (Eid-al-Adha or Qurbani) approaching on the 16th – 18th of June. When will the heat of this trade cool off?

Global Prices For the week ending 18th May, the GB lamb price stood at €9.78/kg, which was €0.15/kg higher than the French price (€9.63/kg), and a whopping €6.26/kg higher than the NZ price (€3.52).

Beef and Lamb NZ have predicted a 54% decrease in profit for many NZ sheep farms due to the poor lamb price This has largely been due to low domestic demand and poor export trade coupled with lower carcass weights due to drought conditions. In addition to which, as the Chinese market has favoured Australian lamb; this has vastly reduced the volume exported to China from New Zealand.

The poor lamb (and mutton) prices in NZ, and the effect on cash flow, are now flowing through to low returns on breeding and feeding stock.

Source: European Commission

In contrast, the Australian flock is going from strength to strength, with the 2024 crop of lambs predicted to show a record production level, potentially 20% higher than the 10-year average, showing a rise of 4% on 2023 to reach 621,000 tonnes. However, the flock is forecast to decrease by 3% in 2024. The main export markets remain in China, USA, Malaysia, and the Middle East.

Bearing in mind, there is a free trade agreement between Australia and the UK, although imports to the UK for January-March 2024 were 3,500 tonnes, 65% higher than 2023, they were lower than 2022. Showing the markets closer to home are more favourable.

European Sheep Trends The European Commission has recently published their Spring Short Term Outlook. The report forecasts that the UK export market will remain stable, while the demand from the Middle East will reduce due to favouring Australian lamb. Imports to the EU, have risen by 2.2% in 2023, largely from UK and NZ, with a further increase of 2.5% forecasted for 2024.

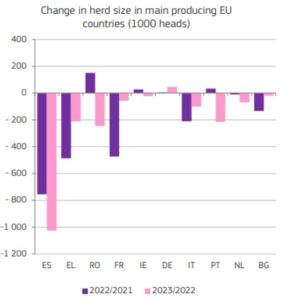

Overall, the European flock is in decline, with the Spanish flock leading with a forecasted reduction of 1 million head or 6.1%. Notable as the Spanish flock currently accounts for 25% of the EU sheep meat production.

Source: DG Agriculture and Rural Development, based on Eurostat

Kirsten Williams; 07798617293

Sign up to the FAS newsletter

Receive updates on news, events and publications from Scotland’s Farm Advisory Service