Agribusiness News June 2023 – Arable

2 June 2023No current incentive to sell

Markets continue their downward trajectory post extension of the Black Sea export corridor to mid-July. For a brief period leading up to the extension, markets priced in the risk of non-renewal. It was short-lived however, with sentiment soon returning to one of unrestricted global supply of cheap wheat, with Russia and Ukraine being aggressive sellers of cheap grain and the market remains anchored by big corn crops across the world. It could be argued that traders are currently ignoring the longer-term Black Sea risk. Were Ukraine to strike Crimea for example, geopolitics and war could still impact markets again.

The market continues to expect record supplies going forward; 2022/23 ending stocks are massive in many regions and the recent USDA Supply and Demand report is expecting a strong restocking season in 2023/2. This highlights the importance of Australia, Brazil and Russia as having record volumes and cheap surpluses of wheat.

South America, in its totality, is developing into a powerhouse regarding maize export capability for 2023/24, anticipated to be in the region of 95Mt and priced to undercut most other origins for both wheat and maize around the world. Markets will be looking ahead to the size of the Brazilian Safrinha maize crop (forming its yield now), plus US maize and soyabean crops. These are expected to be very large crops too, but the critical window for US yield formation is still ahead of us in July and August.

UK Position

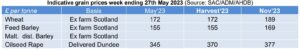

A large carryout is expected here in the UK. Export business is stagnating, late season domestic demand sporadic and the 2023 new wheat crop expectation is currently falling within the 15.7 to 16.2Mt range which would give a very large exportable surplus for 2023/24.

Old crop malting barley markets are disappointing as buyers are all covered. Ex-farm new crop sales remain slow as domestic consumers remain uninterested. New crop feed barley is equally inactive, and prices continue to fall in line with wheat futures.

China may lift the import tariff sanctions they placed on Australian barley back in 2020. Whilst France previously filled this gap in supplying China, not having this market going forward is likely to impact on the UK’s malting barley export competitiveness.

UK oilseed rape values are currently at half of their level a year ago. An expansion in oilseed rape area (Europe’s planted oilseed area has increased by 7%) and a lower-than-average commitment to forward contracts, plus large EU opening stocks and a high yield expectation for this year’s harvest are pressurising prices.

If there can be any consolation at all, one could consider the new season N prices (at time of writing, £330/t for 34.5%N) a step in the right direction. Grain marketing currently appears to favour the long holder.

Wider Oilseed Complex

Concurrently, US Soyabean plantings are progressing a pace and ahead of the 5-year average.

As planting continues, the record crop estimated at 122.7Mt becomes increasingly likely. This will have the potential to continue weighing on oilseed markets towards the end of 2023, which inherently will feed into rapeseed prices too.

Concerns have also been raised this week by the oilseed crushers European organisation FEDIOL, that huge volumes of biodiesel imported as ‘of waste origin’ has had an unprecedented bearish impact on rapeseed markets, a downward trend that could not be explained by other market developments. Calling for proof of legitimacy of these imports, FEDIOL illustrated that prices paid to farmers for new crop rapeseed, based on August 2023 Euronext prices, have gone down from about €600/tonne in early Jan 2023, to just over €400 by mid-May.

On the upside this week, rapeseed futures followed gains in the wider vegetable oils complex with the news that India’s palm oil imports are expected to fall to their lowest in 27 months and will be replaced by soya oil and sunflower oil.

Sign up to the FAS newsletter

Receive updates on news, events and publications from Scotland’s Farm Advisory Service