Agribusiness News July 2024 – Milk

1 July 2024Milk production data

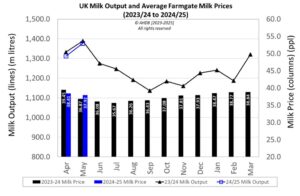

The latest GB monthly milk production data from AHDB is estimated at 1,129m litres for May, 12m litres less than May ‘23 and the lowest volume recorded for May since 2016. According to BCMS dairy cow numbers in the GB milking herd are the same as last year, indicating that the drop in milk volume is due to lower yield per cow. Daily deliveries were 34.95m litres for the w/e 15th June, 1.6% below the previous week and 0.3% down on the same week last year. The UK milk volume for May was 1,377m litres, 5% more than the previous month and 0.9% less than May 2023.

Farmgate prices

The Defra average farmgate milk price for May was 37.92ppl, 0.49ppl down on the April price. The most up to date milk prices from the main Scottish milk buyers available at the time of writing are shown below.

| Milk Prices for June/July 2024 Scotland | Standard Ltr ppl | ||

|---|---|---|---|

| First Milk2 | July | 40.3 | |

| Müller - Müller Direct - Scotland 1, 3 | July | 39 | |

| Grahams1 | July | 37 | |

| Arla Farmers2 | June | 40.89 | |

| Lactalis / Fresh Milk Co.2 | June | 39.53 | |

| Liquid standard litre – annual av. milk price based on supplying 1m litres at 4.0% butterfat, 3.3% protein, bactoscan = 30, SCC = 200 unless stated otherwise. | |||

| Manufacturing standard litre - annual av. milk price based on supplying 1m litres at 4.2% butterfat, 3.4% protein, bactoscan = 30, SCC = 200 unless stated otherwise. | |||

| Includes 1.00ppl Müller Direct Premium. Haulage deducted depending on band for 2023 vs 2021 litres, ranging from -0.25 to -0.85ppl. | |||

Dairy commodities & market indicators

There was a big jump in the latest UK wholesale prices for dairy commodities in June. Butter and cream were up 11% and 9% respectively from May. The lower-than-normal milk volumes around the time of the spring flush, coupled with the seasonal fall in butterfat raised concerns about product availability, with butter stocks now especially low. Cheese stocks are also of concern, with sellers more interested in maturing cheddar stocks to increase value, rather than undersell. As a result, market indicators also rose, with AMPE up 3.42ppl on the back of the significant rise in the butter component. On another positive note, the Milk Market Value was up 2.11pl to 38.65ppl for June, the biggest rise so far this year and this indicator often closely mirrors trends in farm-gate prices in three months’ time.

| UK dairy commodity prices (£/tonne) | Jun | May | Dec |

|---|---|---|---|

| 2024 | 2024 | 2023 | |

| Butter | 5,660 | 5,080 | 4,740 |

| Skim Milk Powder (SMP) | 2,060 | 2,010 | 2,230 |

| Bulk Cream | 2,292 | 2,104 | 2,054 |

| Mild Cheddar | 3,670 | 3,540 | 3,510 |

| UK milk price equivalents (ppl) | Jun | May | Dec |

|---|---|---|---|

| 2024 | 2024 | 2023 | |

| AMPE | 40.5 | 37.08 | 37.96 |

| MCVE | 38.19 | 36.4 | 38.07 |

© AHDB [2024]. All rights reserved.

The latest GDT auction held on 18th June returned a slightly negative change of -0.5% in the GDT price index, with the average price down to US $3,893. The previous five auctions all returned positive results. At the latest auction, butter rose 6.2% although whole milk powder and cheddar fell 2.5% and 1.0% respectively.

Cost of production and benchmarking

Recent reports still put the cost of production above 40ppl and for the 2023/24 milk year, a cost of 43.4ppl was published by The Dairy Group. It is increasingly challenging to control costs without impacting on cow health, milk output and fertility. With feed being the biggest variable cost, it is worth pricing around and getting three quotes for high volume feeds to see if savings can be made. However, make sure you are comparing like-for-like products by looking at feed labels to assess quality of raw materials used. If in doubt seek independent advice. There are many sources of information to benchmark your own costs and feed usage. The latest data from Promar for April 2024 had yield from all forage at 8.1 litres/day, with a yield per cow in milk of 28 litres. Concentrate use was 0.34kg/litre, with a total feed cost of 11.33ppl and a margin over purchased feeds of 27.28ppl.

US bird flu cases

As of mid-June, there were 94 dairy herds confirmed with cases of bird flu (H5N1) across 12 US states. Michigan has the highest number of affected herds, which stands at 25. However, only three human cases have been confirmed, as a result of direct contact with infected cows. It is thought that the disease is being spread from movement of animals, personnel and vehicles and equipment that travel between farms. Several animal health companies are currently developing an avian flu vaccine for cattle. Although Defra is closely monitoring the US situation, there is no evidence that bird flu is present in the UK cattle population and with no recent cases in poultry, the risk from wild birds is low.

Lorna MacPherson, lorna.macpherson@sac.co.uk

Sign up to the FAS newsletter

Receive updates on news, events and publications from Scotland’s Farm Advisory Service