Agribusiness News February 2025 – Sheep

31 January 2025Shoppers Trends

Current lamb trade is at a premium, driven by a good level of demand coupled with global shortages. Looking at our domestic consumer, sales of lamb have shown a 6% rise in volume for 2024 compared to the previous year. Out of home lamb sales have also increased on the year by 8%.

AHDB have shown that shoppers’ main purchasing decision is price; this sits at 71% of customers, back 5% on 2023. Areas of importance that have grown over the last year include: local, taste and appearance, ease of cooking, brand and health. This survey has shown 61% of lamb consumers are aged 55+, however there is a growing consumption in the 35-44 year old age group, which shows an increase of 23% on the year.

From this it is clear, we need to promote the taste, and health credentials of lamb, while looking to focus on quick simple meals and different cuts to meet this market requirement.

Christmas Trends

While shoppers’ trends are showing an advantage for lamb, the run up to Christmas did not come with promotions on red meat in the supermarkets. Whole turkey and whole chicken showed increases on the year of 2.4% and 2.3% in volume sales Both of which were focussed on for supermarket promotions. Roasting gammon joints showed a 1.4% increase, but very interestingly, almost a quarter (24.4%) of the roasting gammon sales for the year were sold in December. Roasting beef, lamb, pork and whole fish all saw decreases in volume sales year on year.

Markets

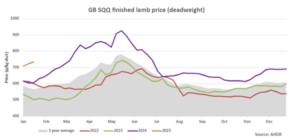

2025 sheep trade has started with a bang! Store, prime and cull rings are showing a premium on the year. Slaughter numbers have increased over January, with more lambs coming forward prime. Ramadan starts on the 28th February, which will further drive demand from prime sales. Week ending 18/01/25 shows a £1.27/kg DW rise on SQQ compared to 2023.

Australia – The Export Machine!

Exports totals have been released by Meat and Livestock Australia for 2024. These show how record volumes have been exported for beef, lamb, mutton and goat meat. Lamb exports increased by 10% on the year to 359,229t and mutton exports increased by 22% on the year to 255,098t. The main markets for lamb were US (23%), China (15%) and United Arab Emirates (7%) and the main markets for mutton were China (37%), Malaysia (10%) and US (7%).

Getting your goat

Interestingly, Australian goat exports rose 52% on 2023. The previous record year for goat exports was 2014, the 2024 exports saw a 44% rise on this! The total exported in 2024 was 51,488t shipped weight. The reasons for this are due to favourable weather and increased slaughter capacity for goats. The US took 54% of these exports, followed by Korea (17%) and China (10%).

The 1st of January 2025 saw the UK enter its 3rd year of the free trade agreement (FTA) with Australia. Now with a 0% tariff on the first 36,111 tonnes of sheep meat. Of the 30,556 tonnes allowance in 2024, a total of 13,668 tonnes was imported, which shows a 44% rise on 2023, however, the initial year was only 6 months long starting on the 31st May.

Kirsten Williams, kirsten.williams@sac.co.uk, 07798617293

| Week ending | GB deadweight (p/kg) | Scottish auction (p/kg) | Ewes (£/hd) | ||||||

|---|---|---|---|---|---|---|---|---|---|

| 16.5 – 21.5kg | Scottish | ||||||||

| R3L | Change on week | Diff over R2 | Diff over R3H | Med. | Change on week | Diff over stan. | Diff over heavy | All | |

| 4-Jan-25 | 712.7 | 19.2 | 2.9 | -0.2 | 342.6 | 1.6 | 7.7 | 11.4 | 134.91 |

| 11-Jan-25 | 730 | 17.3 | 3.1 | 2.2 | 350.8 | 8.2 | 9 | 11.7 | 135.02 |

| 18-Jan-25 | 741.8 | 11.8 | 1 | 0.6 | 347.7 | -3.1 | 10 | 13.9 | 136.08 |

Sign up to the FAS newsletter

Receive updates on news, events and publications from Scotland’s Farm Advisory Service