Agribusiness News February 2025 – Beef

31 January 2025Short Supply & Record Prices Continue

Currently finished beef prices are at record levels. Never have finishers seen prices at these levels in January. Prices at abattoirs and in the live ring have rocketed, with consumer demand and tightening cattle supplies leading to a growing shortage of all types of cattle.

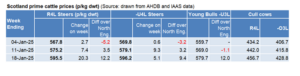

Deadweight prices post-Christmas were sitting at 14.5% higher than a year ago and a whopping 35.6% higher than the 5-year average.

Prices have lifted by 25p/kg/dwt in just two weeks with prices available at the time of writing (week beginning 27/01) sitting at 610-615p/kg/dwt. A 380kg carcase is currently returning around £2,320, an increase of £550 from June 2024, when beef prices were at a low of 470p/kg/dwt.

Finishers emptied sheds pre-Christmas on the back of strong finished prices, with several processors increasing prices in the final week of Christmas slaughterings which hasn’t helped with subsequent numbers available for slaughter. In short, the numbers aren’t there.

The declining beef herd in Scotland and high numbers of Scottish stores being sold into England has undoubtedly tightened the Scottish supply, leaving a big hole in prime cattle supplies. Simply, we are getting short of cattle in the UK and competition to secure cattle is very much evident.

With market demand and prices are changing daily it is very difficult to predict where prices will be in the coming weeks. Reports suggest that finished prices for steers and heifers will likely stabilise, as current prices are not sustainable, which is the feeling echoed around store cattle rings.

Store Cattle

The uplift in finished cattle prices as expected has filtered through to the store ring. Store cattle prices in January have also started very strongly with many markets reporting £4/kg liveweight. With tightening numbers of stores coming forward, indications are that spring numbers of store cattle will be short, and expensive.

While increased store cattle prices are currently an incentive for those suckler producers who have been questioning the viability of their herds; for many this uplift is needed with production costs also increasing, especially in upland areas. However, the current store cattle trade for many finishers is not sustainable, especially for those having to fork out £2,000/head for short-keep cattle. Although it is helping that feed and protein prices are below previous years; finishers are hoping that prices remain stable to provide a sustainable margin.

Cull Cows coming into their own

Demand for manufacturing beef (mince etc.) continues with prices increasingly significantly since Christmas. Prices currently being quoted for cull cows are around 480p/kg deadweight. With cow supplies down on 2024 levels, there is pressure to find ‘mince beef’.

The realisation that cull cows are no longer a ‘by product’ but actually a valuable ‘product’ has seen farmers look to maximise returns and to re-evaluate their culling and replacement policy, to try a maintain a more efficient suckler herd. However, the problem with that just now is replacements. While current beef prices are a real confidence boost to the industry; the cost of replacements is also high, so generally, it means everyone has got more money tied up for the same margin.

Sarah Balfour, sarah.balfour@sac.co.uk

Sign up to the FAS newsletter

Receive updates on news, events and publications from Scotland’s Farm Advisory Service