Agribusiness News August 2024 – Cereals and Oilseeds

1 August 2024Sharp US price falls impact markets

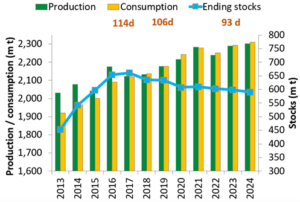

The global wheat outlook for 2024/25 is for larger supplies, consumption, trade, and stocks. Supply forecasts have been increased by 6.9Mt to 1,057Mt, primarily due to larger beginning stocks for several countries and higher production. (Fig.1)

Fig 1 Source USDA

The USDA’s July report estimated that Canada, the US, Argentina, and Australia will produce an additional 14 Mt of wheat in 2024, which will offset the anticipated 15 Mt drop in production from the EU and Black Sea regions. This is expected to heighten competition and drive more aggressive pricing in key export markets, creating a bearish outlook for global wheat markets and domestic prices.

Specifically, US wheat production is expected to increase by 55 Mt, a 10 Mt increase from the previous three-year average. July saw a continuation in the decline in US wheat price as the country adjusted to a situation where supply fears have all but vanished. Chicago Dec ‘24 wheat futures consequently now trading at a £30/t discount to London Nov ‘24 wheat futures.

The market is currently evaluating both the negative impact of this rising US wheat stock combined with aggressive Russian wheat sales and comparing it to the upside potential from reduced EU production and associated EU quality concerns.

As the US will need to find new markets; US wheat prices are reflecting this shift. We may see stronger export figures from the US, including sales to “unusual” destinations like Europe or North Africa.

Overall, global markets should be well-supplied this season, with export surpluses more evenly distributed among various regions. Even if production decreases in Europe, the UK, Russia, or Ukraine; domestic prices may not rise automatically due to the competitive shipping costs between continents.

EU and Black Sea harvest progress

The European Union crop monitoring service’s July yield forecast for the EU-27 has reduced yield estimates for most crops due to ongoing extreme weather. Heavy rainfall in Germany and France has led to flooding and difficulties in managing winter crops, increasing pest and disease pressure and delays in planting summer crops in Belgium and Luxembourg have not been offset. Major crops such as maize, rapeseed, and sunflowers are below their five-year average yields, though spring barley yields have improved due to favourable weather in Spain and northern Europe.

For the past several years, EU and Black Sea wheat have dominated North African and Middle Eastern markets, with less competition from Argentina and US wheat. However, this season, US wheat is likely to challenge these markets. Aside from the fall in US wheat prices, the UK values too have been negatively impacted throughout July, losing £10/t on Nov’ 24 contract prices. As markets stabilize however, US prices are expected to rebound slowly. The recent price drop is also attributed to harvest pressure from the Black Sea region; at this early stage of the season, Russia, Ukraine, Romania, and Bulgaria are competing in the same markets to manage their post-harvest flows.

In the malting barley market, across Europe, the outlook is positive. Despite weather concerns, France is progressing well with its spring harvest, although yields are down; the increased area of spring barley planted supports malting barley availability. Denmark, another key producer, reports crops in good condition ahead of harvest.

Mark Bowsher-Gibbs, mark.bowsher-gibbs@sac.co.uk 07385 399 513

| £ per tonne | Basis | August ’24 | Harvest ’24 | Nov’24 | Mar’25 |

|---|---|---|---|---|---|

| Wheat | Ex farm Scotland | 183 | 187 | 189 | 197 |

| Feed Barley | Ex farm Scotland | 145 | 150 | 152 | 165 |

| Milling Oats | Ex farm Scotland | 265 | |||

| Oilseed Rape | Delivered Dundee | - | 368 | 376 | 380 |

| Beans | Ex farm Scotland | 240 | |||

| Indicative grain prices week ending 31/7/2024 Source: SAC//United oilseeds/Farmers weekly/AHDB) | |||||

Sign up to the FAS newsletter

Receive updates on news, events and publications from Scotland’s Farm Advisory Service