Agribusiness News May 2024 – Milk

1 May 2024What spring flush?

- Milk volumes are well down on this time last year.

- Weather impacts on grass growth has curtailed the seasonal rise in milk volumes.

- Commodity market prices show little change and no sign of significant improvement in milk price in the short-term.

Milk production data

The latest milk production data from AHDB shows that GB milk output for March was 1,086m litres (provisional), 11.4% more than February’s volume. Daily deliveries were 35.67m litres for the w/e 13th April, just 0.3% above the previous week but 2.2% down on the same week in 2023. UK production for March was 1,322m litres, 12.0% more than the previous month but no change from March 2023.

Farm-gate prices

The Defra average UK milk price for March 2024 was 37.42 ppl, down 0.57 ppl from February and 14% lower than March 2023. The most up to date milk prices from the main Scottish milk buyers available at the time of writing are shown below. First Milk has increased its May price by 0.75 ppl, which is their fourth consecutive monthly rise.

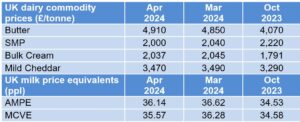

Dairy commodities & market indicators

The latest UK wholesale dairy commodity prices for the week beginning 18th March to the 15th April showed very little change from the previous month, with only a positive movement for butter (+1%), due to limited stocks and lower milk volumes (particularly in Ireland) reducing production. Again, markets have been quiet these last few weeks as buyers and traders wait to see how milk production pans out in the run up to the seasonal peak. The market indicators AMPE and MCVE both dropped, and the Milk Market Value indicator also fell 0.67 ppl from March. This is the third consecutive drop in a row, giving little hope of milk prices rising much further over the coming months.

© AHDB [2024]. All rights reserved.

The latest GDT auction (16th April) showed little change in the average price across all products sold, down just 0.1% to $3,590/t. The previous auction at the start of April was more positive, with the index up 2.8%. At the latest auction, the biggest price drops were seen in cheese products, with cheddar down 8.5% to $3,974/t and mozzarella back 3.8% to $3,755/t.

GrassCheck GB and nitrate warning

Data from GrassCheck GB shows a slow start to grass growth this year, which is not surprising given the cold, wet spring. Combined with low soil temperatures, grass growth at the end of April is predicted to be around just 20kg DM/ha/day, which is below the 5-year average. However, grass quality is good at 18.4% protein and 11.2ME. For a 650kg cow with a grass dry matter intake of 16kg, this should support M+20 litres of milk.

For those with late slurry and fertiliser applications this spring, it is worth testing fresh grass for nitrates prior to cutting to sure that all N applied has been used up. High levels of nitrates (>0.1% or >1000mg/kg in the fresh weight) can lead to poorer fermentation and reduced intakes, affecting animal performance. If over 0.25%, the advice is to delay cutting and retest the grass in three to five days. You can get a rough idea of whether all applied N has been used from the date of application, based on an N uptake of 2.5kg/ha (2 units/acre). If conditions are less favourable, add a safety margin of +7 days. For example, under favourable conditions, an application of 120kg N/ha will be fully utilised by seven weeks post-spreading (120/2.5 = 48 days). If applying only 80kg N/ha then it should be safe to cut after 32 days.

Lorna MacPherson, lorna.macpherson@sac.co.uk

Sign up to the FAS newsletter

Receive updates on news, events and publications from Scotland’s Farm Advisory Service