Agribusiness News August 2023 – Pigs

31 July 2023A summer of optimism for the sector as pig prices keep rising on the back of falling feed prices with producer margins now back in the black.

So far 2023 has been notable for the UK pig sector as prices have continued to rise on a weekly basis, finally allowing producers to turn the corner after more than two years of substantial losses. Supplies of finished pigs are extremely tight as the sector has contracted and the shoots of recovery are there with some of the larger processors with pigs of their own, now increasing sow numbers to maintain supply.

Standard Pig Prices (SPP): From a low of 137 p.p.kg in February 2022, the SPP has now reached just under 225 p.p.kg in less than eighteen months – a rise of 64%. Pig meat from the EU, for so long the cheap alternative that has kept a lid on UK prices and displaced it from supermarket shelves, has also risen substantially over the past eighteen months as sow numbers have also dropped dramatically on the continent with the influential German price now the equivalent of 217 p.p.kg.

Slaughter Weights: Slaughter weights have remained consistently between 88 – 89kg for some time despite the reduced numbers coming forward. Numbers slaughtered weekly in England, Scotland and Wales were 41,700 and 26,700 lower in the first two weeks of July 2023 than the same weeks in 2022. While processors did pull pigs forward as numbers first started to reduce at the start of the year, the processing sector seems to have adjusted and contracted to match the fall in supply, with some sites closing and others moving to four-day weeks.

Cull Sows & Weaners: For much of the past few years cull sow values have been extremely low, partly due to BREXIT and also due to the greater numbers coming forward as farmers either reduced sow numbers or dispersed herds altogether. While February 2022 saw cull sow values at around 20 p.p.kg, prices have risen steadily since then with a cull sow now worth around £140 p.p.kg. (T.V.C.). The much-improved outlook for the sector in terms of finished pig prices and reduced feed costs has also led to much more demand from specialist finishers with 7kg weaners trading at ~ £55/head with any surplus pigs finding a ready buyer.

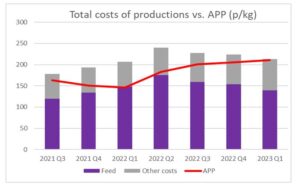

Costs of Production: Even though prices have continued to rise to record levels, the latest published margins from AHDB (for Q1 of 2023) showed pig farmers were just short of breaking even. Total costs had fallen considerably from the peak of 240p.p.kg (£214 per pig) in Q2 of 2022 to 213p.p.kg (£189 per pig) by Q1 in 2023, with prices received rising to 211p.p.kg (£187 per pig). Apart the rise in prices received the main driver was the fall in feed prices which had fallen from 175p.p.kg to 139p.p.kg over the same period, falling from an unprecedented 73% of production costs to a more normal 65%. The next set of published results are expected to show a positive margin as prices have continued to rise and feed prices have continued to fall.

Figure 1. GB All Pigs Price (APP) vs. Cost of production Jan 2021 to Mar 2023, (Source: AHDB Pork)

Imports & Exports

The reduction in finished pigs in the UK has had knock-on effects to both imports and exports. The latest import figures for the month of May 2023, revealed an increase of 9,300 tons of pig meat (16%) were imported to the UK compared to April. Imports from Denmark, Germany and the Netherlands accounted for nearly 58% of the total imports. This has been blamed on reduced availability of UK pig meat for the home market (AHDB).

Conversely, the reduced availability of UK product at home has seen exports fall slightly in May by 1000 tons (4%) compared to the previous month, falling to 24,000 tons. More interesting was the year-on-year reduction, with 12,000 less tons exported compared to May 2022, again for largely the same reason.

African Swine Fever (ASF): A commercial farm in Italy has now been affected as ASF continues to move across Europe spreading both in the wild boar populations and, as is suspected in Italy and several other outbreaks, by human activities. UK producers are being asked to review their biosecurity measures and remain vigilant, with illegal meat imports from affected areas still being intercepted at ports.

Outlook: Continuing tight supplies supporting prices in the short and medium term combined with reduced feed prices will allow producers to claw back some of the losses made over the past few years. Whether profits are high enough to provide the confidence to make investments or expand remains to be seen.

Sign up to the FAS newsletter

Receive updates on news, events and publications from Scotland’s Farm Advisory Service