Agribusiness News August 2023 – Milk

31 July 2023Little positivity in milk markets

- Milk volumes are still declining, as is the seasonal trend, with average daily production slightly ahead of last year.

- Little sign of any improvement in milk price on the horizon based on domestic wholesale price and the GDT auction.

Milk production data

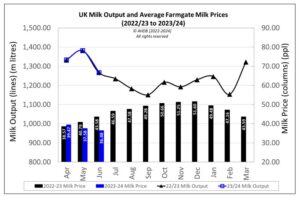

The latest milk production data shows that UK milk output for June 2023 was 1,267m litres, 8.5% less than the previous month but on a par against June 2022. As of the week ending 15th July, daily milk deliveries were 0.6% above the same week last year at 33.33m litres.

According to Grasscheck GB, grass growth rates are now well above the 4-year average at 67.1kg DM/ha as of 24th July. Recent rains have enhanced grass growth rates and grass protein levels have improved across dairy, beef and sheep farms to 17.3% crude protein, with an ME of 10.5MJ/kg DM. Based on a 650kg spring-calving dairy cow consuming 15kg DM from grass, this equates to M+15.6 litres from grass alone.

Farmgate prices: August 2023

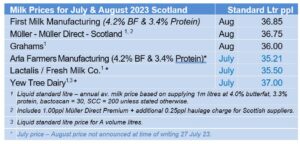

The UK average milk price for June 2023 was 36.48ppl – down 1.1ppl from May and 16% lower than June 2022. Milk processors have either reduced their price for August or held at the July price.

The milk price that Arla’s 2100 farmer members in GB receive for August will partly depend on how many points they score from 19 environmental sustainability measures. Up to 80 points are available at 0.03 eurocent/kg of milk – max. 2.4eurocents/kg or 2.2ppl.

Dairy commodities & market indicators

Trade in dairy commodity products has been very quiet over the summer holiday period. Both market indicators AMPE and MCVE fell for July 2023, reflecting decreases to the wholesale prices of butter, SMP and mild cheddar from 26th June to 17th July. Only cream showing a 1% uplift in price. Limited demand and falling prices at the GDT auction are continuing to put downward pressure on prices.

The latest GDT auction held on 18th July returned another negative change to the price index of -1% from the previous auction to an average of $3,289/t. Five out of the last eight auctions have shown a downward trend in the price of dairy commodities sold. At this recent auction, cheddar dropped 10.1% to $3,955/t and butter fell 2.7% to $4,705/t.

Looking forward

Although milk volumes are falling, there are still ample supplies around both here and in the EU. There is little demand for product and sellers are under pressure to reduce their prices. As demand is not likely to increase any time soon (Chinese imports are well below historic levels, keeping GDT auctions bearish), the only thing that would help stimulate an increase in the milk price is for volumes to crash.

Currently, the futures commodities markets convert to a milk price of just below 30ppl from now until the end of October and above 30ppl for Nov & Dec. Therefore, there is still a possibility of further milk price reductions this autumn before things start to improve. Globally, milk volumes need to drop by 1 to 2% in order to correct the imbalance between supply and demand. With input costs still relatively high in comparison to the milk price, many farmers will be struggling with negative cash flows.

According to the Scottish Dairy Cattle Association, there are now just 799 dairy herds in Scotland (as of 1st July), a loss of 20 herds from this time last year. The average herd size is 223 and the total number of milking cows is 178,460, a drop of only 94 since the start of the year. Ayrshire is home to the highest number of herds at 209, followed by Dumfriesshire at 148 herds.

lorna.macpherson@sac.co.uk, 07760 990 901

Sign up to the FAS newsletter

Receive updates on news, events and publications from Scotland’s Farm Advisory Service