Agribusiness News July 2023 – Milk

3 July 2023Have milk prices bottomed out?

- Milk volumes are falling rapidly, there are fewer and smaller price cuts for July compared to recent months and commodity markets appear to be fairly stable.

- Farm-gate milk prices are now in the region of between 35-38ppl from the main Scottish milk buyers, depending on the type of supply contract, with supermarket-aligned contracts still above 40ppl.

Milk production data

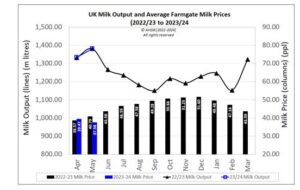

Milk production data shows that UK milk output for May 2023 was 1,381.76m litres – an increase of around 0.35m litres on a year-on-year basis (+0.03%) and 3.65% higher than April 2023.

According to GrassCheck GB, grass growth rates have been steadily dropping throughout June on the back of hot, dry weather. Quality is also being affected due to moisture stress, with average crude protein levels of just 14.1% and an ME of 10.6MJ/kg DM. Despite recent rains in some areas, grass is in short supply and milk volumes are unlikely to rise anytime soon.

Farmgate prices: July 2023

The UK average milk price for May 2023 was 37.58ppl – down 1.89ppl from April and 7.86% lower than May 2022. The main Scottish milk buyers have either reduced their price for July or held at the June price.

According to The Dairy Group, the estimated cost of production for the 12 months up to March 23 was 45ppl. Not surprisingly, the biggest increases were in feed, fertiliser, power and labour. With family labour costed at 3ppl, they estimate the break even cost to produce milk this year is 40ppl (not taking into account grants, subsidies and other income). While feed costs have eased back, with the current milk price margin over purchased feeds is predicted to drop by £350/cow for the year up to March 24. This equates to £70,000 less for a 200-cow herd. Based on current forward prices for straights and assuming good quality forage, it is thought that concentrate feed costs of around 8ppl this winter should be attainable.

Dairy commodities & market indicators

There were small increases to the values for AMPE and MCVE for June 2023, reflecting increases to the value of butter and SMP. The table below shows that UK wholesale prices have in fact increased (slightly) across the board. Whilst there’s a long way to go before announcing any grand recovery to milk prices, this does at least suggest that price levels are beginning to stabilise.

The latest Global Dairy Trade (GDT) auction held on 20th June showed no difference in the price index, with a 0% change in the average price index, remaining at $3,479/t from the previous auction two weeks ago. While the average butter price rose 5.5% (to $5,379/t), cheddar and skim milk powder both fell 3.3% (to $4,533/t) and 2.3% (to $2,667/t) respectively.

Looking forward

While market indicators point towards the milk price having bottomed out and more stability in dairy markets, industry analysts predict that recovery will be slow and any milk price rises are unlikely to materialise in the short-term. There are plentiful butter stocks, cheddar prices remain stable (although young cheese prices have been slowly rising) and with some big supermarket tenders currently on-going, significant rises are unlikely to materialise at the moment. This means we could be looking at little movement in the milk price until at least the last quarter of 2023. In addition, consumer demand for dairy products is still back, both domestically and globally. However, milk volumes are still below forecasted levels and if the summer drought continues to impact volumes this may help drive positive milk price changes a little quicker.

lorna.macpherson@sac.co.uk, 07760 990 901

Sign up to the FAS newsletter

Receive updates on news, events and publications from Scotland’s Farm Advisory Service